A home equity loan, also known as a second mortgage, allows homeowners to borrow money against the equity in their homes. It is a type of consumer debt that provides a lump sum payment and is repaid in fixed monthly installments.

Home equity loans come with low, fixed rates and can help increase the value of your home when used wisely. However, it’s important to consider the downsides, such as the possibility of losing your house and the potential to owe more than your home is worth.

In addition, there are alternatives to home equity loans, such as HELOCs, cash-out refinances, and personal loans.

How Does A Home Equity Loan Work?

What is a home equity loan?

A home equity loan, also known as a home equity installment loan or a second mortgage, is a type of consumer debt. Home equity loans allow homeowners to borrow money using their homes as collateral.

Understanding the concept of equity

Equity is the difference between the appraised value of your home and the outstanding balance on your mortgage. It represents the portion of your home that you truly own.

Using your home as collateral

When you take out a home equity loan, the lender places a lien on your property, which means they have a legal right to seize your home if you fail to repay the loan.

Lump-sum payment and fixed-rate repayment

A home equity loan provides you with a lump-sum payment upfront, which you must repay with fixed monthly installments over a set period of time.

Home equity loans can be a helpful financial tool for homeowners who need to borrow money for large expenses, such as home improvements, debt consolidation, or education expenses. However, it’s important to carefully consider the pros and cons of a home equity loan and understand how it works before taking one out. Remember to compare interest rates, loan terms, and repayment options from different lenders to find the best option for your specific needs and financial situation.

Qualifications And Requirements For A Home Equity Loan

A home equity loan is a type of consumer debt that allows homeowners to borrow against the equity they have built up in their homes. This loan is also referred to as a home equity installment loan or a second mortgage. Homeowners can use the loan for various purposes, such as home improvements or debt consolidation.

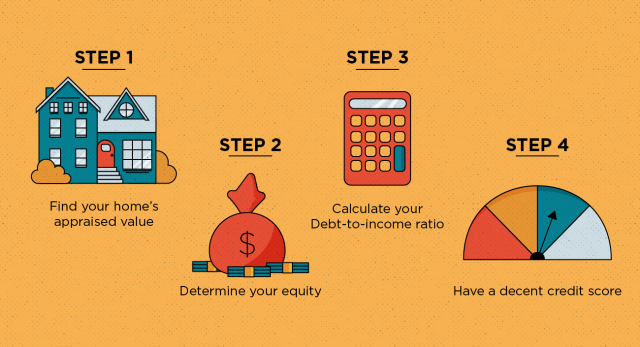

Qualifying for a home equity loan requires meeting certain requirements. These include:

- Home equity requirements: To be eligible for a home equity loan, homeowners must have sufficient equity in their homes. The amount of equity required varies between lenders.

- Credit score and income considerations: Lenders typically consider borrowers’ credit scores and income when assessing their eligibility for a home equity loan. Having a good credit score and stable income can increase the chances of approval.

- Loan-to-value ratio (LTV): Lenders also consider the loan-to-value ratio, which is the ratio of the loan amount to the appraised value of the home. Lenders may have specific LTV requirements for home equity loans.

- Documentation needed for the application process: Borrowers will need to provide documentation such as proof of income, tax returns, and property appraisals during the home equity loan application process.

Understanding the qualifications and requirements for a home equity loan is crucial before applying for one. Meeting these requirements increases the chances of approval and ensures a smooth loan application process.

Benefits And Drawbacks Of A Home Equity Loan

| Benefits of a Home Equity Loan: |

|

| Drawbacks of a Home Equity Loan: |

|

A home equity loan provides homeowners with the ability to access cash for various needs. This can be especially beneficial when facing unexpected expenses or when looking to fund home improvements or other significant purchases. Furthermore, home equity loans may offer potentially lower interest rates compared to other forms of borrowing, making them a cost-effective option for those in need of funds. There are also potential tax advantages associated with home equity loans in certain situations. However, it is important to understand the drawbacks of this type of loan. One major drawback is the risk of foreclosure if you are unable to repay the loan. Additionally, there is a possibility of owing more than your home’s value, which can create financial challenges in the long term. Furthermore, the application process for a home equity loan is often longer and more stringent compared to other types of loans. This may involve providing extensive documentation and undergoing a thorough credit evaluation. Overall, while a home equity loan can provide immediate access to funds, it is important to carefully consider the potential risks and drawbacks before proceeding with this type of borrowing.

Using A Home Equity Loan: Popular Applications

A home equity loan, also known as a home equity installment loan or a second mortgage, is a type of consumer debt. Home equity loans allow homeowners to borrow money using the equity in their homes as collateral. It enables them to access cash by tapping into their existing home equity. The loan amount is dispersed in a lump sum and repaid with fixed-rate monthly installments. Home equity loans are often used for popular applications such as:

- Home improvements and renovations: Homeowners can use a home equity loan to fund renovations and upgrades to their property, increasing its value and improving their living space.

- Debt consolidation: Borrowers can consolidate their high-interest debts into a single, lower-interest home equity loan, simplifying their payments and potentially saving money on interest.

- Financing education or large expenses: Homeowners can use a home equity loan to finance their educational expenses or other significant life events.

- Starting a business or investment opportunity: Some borrowers use a home equity loan as capital to start a new business venture or invest in lucrative opportunities.

Overall, a home equity loan provides homeowners with flexible financing options based on the equity they have built in their homes.

Home Equity Loan Vs. Home Equity Line Of Credit (HELOC)

A home equity loan, also known as a home equity installment loan or a second mortgage, is a type of consumer debt that allows homeowners to borrow money using their home’s equity as collateral. It provides a lump-sum payment that is repaid with fixed-rate monthly installments. Home equity loans come with low, fixed rates and are a good option when used to increase the value of the home. However, it’s important to understand the key differences between a home equity loan and a home equity line of credit (HELOC). A HELOC is a line of credit borrowed against the available equity of the home, providing flexibility to borrow money as needed. Both options have their pros and cons, depending on individual financial needs. It’s important to carefully consider which option is best suited for your specific circumstances.

How To Calculate The Potential Home Equity Loan Amount

Bank Home equity loans, also known as home equity installment loans or second mortgages, allow homeowners to borrow money using their home as collateral. These loans are typically one-time installment loans with fixed rates and provide a lump sum payment to the borrower. The loan amount is determined by factors such as the home’s appraised value, the outstanding mortgage balance, and the combined loan-to-value ratio (CLTV). To calculate the potential home equity loan amount, homeowners can use a loan-to-value (LTV) calculator. This tool takes into account the appraised value and outstanding mortgage balance to determine the available equity. Another factor to consider is the impact of existing mortgages and liens. Any existing debts secured by the home, such as a first mortgage or liens, can affect the maximum loan amount. Before pursuing a home equity loan, it’s important to weigh the pros and cons. While these loans can provide access to cash, borrowers must be cautious about the possibility of losing their home, owing more than it’s worth, and the longer and more stringent application process. Homeowners should also explore alternative options such as HELOCs, cash-out refinances, and personal loans.

Steps To Apply For A Home Equity Loan

A home equity loan, also known as a home equity installment loan or a second mortgage, is a type of consumer debt. Home equity loans allow homeowners to borrow money using their home as collateral. This type of loan can be used for various purposes such as home renovations, debt consolidation, or paying for major expenses.

Researching and comparing lenders is an important step before applying for a home equity loan. It’s crucial to find a reputable lender that offers competitive interest rates and favorable terms. Gathering necessary documents and information is another important step in the application process. Lenders typically require documents such as proof of income, proof of homeownership, and documentation of any existing debts.

Once all the necessary documents are gathered, the next step is to submit the loan application. This can typically be done online or in person at the lender’s office. After submitting the application, the lender will review all the provided information and perform a thorough assessment of the borrower’s creditworthiness.

The timeline and process of loan approval and closing can vary depending on the lender and the borrower’s individual circumstances. It’s important for borrowers to stay in communication with the lender and provide any additional documents or information requested.

Tips For Maximizing The Benefits Of A Home Equity Loan

Home Equity Loan

A home equity loan, also known as a home equity installment loan or a second mortgage, is a type of consumer debt. Home equity loans allow homeowners to borrow money using the equity they have built in their homes as collateral. This type of loan provides a lump sum payment that is repaid over time with fixed monthly installments. Home equity loans can be used for various purposes, such as home renovations, debt consolidation, or other major expenses. It is important to carefully plan and budget for the usage of a home equity loan to make the most of its benefits. By exploring different loan terms and repayment options, homeowners can find the best approach that suits their financial needs and goals. However, it is crucial to be cautious about borrowing too much or unnecessary spending to avoid potential downsides such as a longer application process and the risk of owing more than the home is worth.

Risks And Considerations When Taking Out A Home Equity Loan

When considering taking out a home equity loan, it’s important to carefully evaluate the potential impact on your credit score. Taking on additional debt can have a negative effect on your credit score if you’re unable to make timely payments. It’s crucial to assess your ability to repay the loan and determine if the monthly payments fit comfortably within your budget.

Furthermore, it’s essential to consider the long-term financial implications of a home equity loan. While it can provide access to cash, using your home as collateral means there’s a risk of losing your house if you’re unable to repay the loan. Additionally, there may be a longer and more stringent application process compared to other loan options.

Pros And Cons Of Home Equity Loans

| Pros | Cons |

|---|---|

| Access to cash | Potential risk of losing your home |

| Low fixed rates | Possibility of owing more than your home is worth |

| Collateral provided by your home | Longer and more stringent application process |

Frequently Asked Questions For Home Equity Loan

What Is The Downside Of A Home Equity Loan?

The downsides of a home equity loan include the risk of losing your house, the potential to owe more than your home is worth, and a longer and more stringent application process. Consider alternatives like HELOCs, cash-out refinances, or personal loans.

How Much Would A $50000 Home Equity Loan Cost Per Month?

A $50,000 home equity loan could cost around $500 per month, but it depends on various factors such as the interest rate, loan term, and any additional fees. It is recommended to use a loan calculator or consult with a lender for an accurate estimate.

Is It Good To Borrow From Home Equity?

Borrowing from home equity is a good idea if it’s used to increase your home’s value. It allows you to borrow a lump sum against your home’s equity and repay it with fixed monthly payments. However, consider the downsides like the possibility of losing your house and a longer application process.

Explore alternatives like HELOCs, cash-out refinances, and personal loans.

What Is A Home Equity Loan?

A home equity loan, also called a second mortgage, allows homeowners to borrow money using the equity in their home as collateral. The loan is paid back in monthly installments, providing a lump sum of cash. It can be a good option to increase the value of your home and comes with fixed rates.

Conclusion

To sum up, a home equity loan provides homeowners with the opportunity to borrow money by using the equity they have built in their homes as collateral. With low fixed rates and the ability to receive a lump sum payment, this type of loan can be a convenient way to access cash.

However, it is important to consider the potential downsides such as the risk of losing your home and the possibility of owing more than it is worth. Before deciding on a home equity loan, it is advisable to explore alternative options and carefully evaluate your financial situation.